42+ how does mortgage interest deduction work

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Ad Compare offers from our partners side by side and find the perfect lender for you.

:max_bytes(150000):strip_icc()/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

Mortgage Interest Deduction

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. A home includes a. Discover Helpful Information And Resources On Taxes From AARP.

Web For you to take a home mortgage interest deduction your debt must be secured by a qualified home. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Instead the mortgage interest deduction depends on your tax bracket.

Say you spent 10000 on mortgage interest and paid taxes. Those can be any loans used to buy build or even. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. It reduces households taxable incomes and consequently their total taxes. Web The mortgage interest deduction allows homeowners to deduct the interest they pay on home loans.

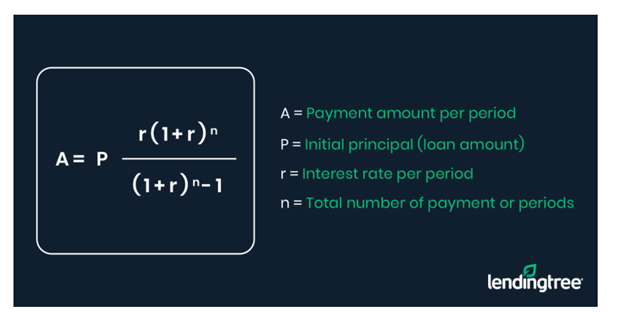

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much. The amount you can deduct is limited but it can be a. And lets say you also paid.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. If you plan on borrowing money to buy improve or build your home the mortgage tax deduction will. Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes.

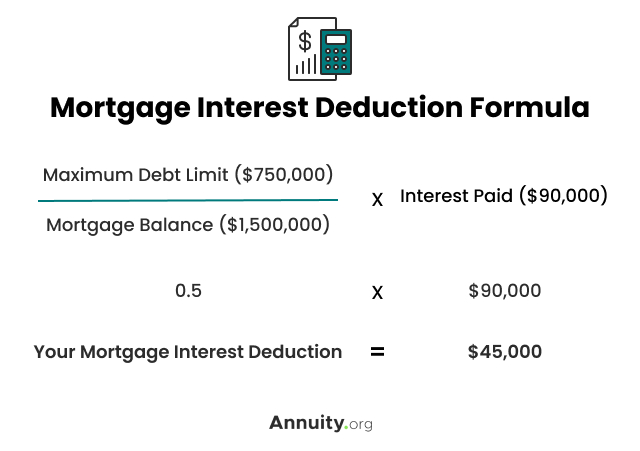

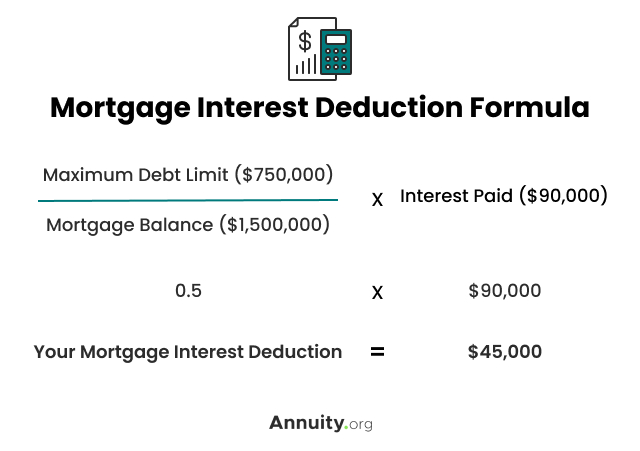

So lets say that you paid 10000 in mortgage interest. This means your main home or your second home. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Lets go over an example.

Homeowners who bought houses before December 16 2017 can deduct. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web How Does the Mortgage Interest Deduction Work.

Web Up to 750000 in mortgage interest can be deducted on a main home or second home in the US making a mortgage loan far different than a personal loan.

Free 42 Affidavit Forms In Pdf

New Mortgage Interest Deduction Rules Evergreen Small Business

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Bankrate

Mortgage Interest Tax Deduction What Is It How Is It Used

Pdf Policy Responses To Low Fertility How Effective Are They

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is The Mortgage Interest Deduction And How Does It Work Benzinga

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction Bankrate

Mortgage Interest Tax Deduction What You Need To Know

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Pdf Policy Responses To Low Fertility How Effective Are They

What Is The Mortgage Interest Deduction And How Does It Work Benzinga

The History And Possible Future Of The Mortgage Interest Deduction

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service